laws cars laws vehicle insurance

laws cars laws vehicle insurance

What is detailed insurance coverage? Comprehensive protection helps cover the expense of problems to your automobile when you're included in an accident that's not caused by an accident.

Comprehensive coverage is an optional coverage you can lug to assist secure your lorry. Unlike some coverages, you don't choose a limitation for comprehensive. The most it will pay is based on the actual cash money value of your lorry. You will be in charge of paying your picked insurance deductible. Let's interact to locate the appropriate protection for you.

It's sometimes referred to as "apart from accident" protection (vehicle). All that indicates is that it might cover damages to your vehicle that crash protection doesn't. This may consist of, but is not limited to, points like: Theft Glass damage Fire Floods and also hail Hitting an animal What damages is not covered by comprehensive insurance coverage? Comprehensive protection does not cover problems brought on by hitting one more car or things.

It will certainly also not cover regular wear and tear on your vehicle - suvs. Regular deterioration consists of items that generally need to be changed with time from usage such as: Belts and hoses Brakes Tires Windshield wipers Comprehensive Coverage vs. Collision Protection Comprehensive protection and also collision coverage can be used to assist fix the problems triggered to your vehicle in a crash.

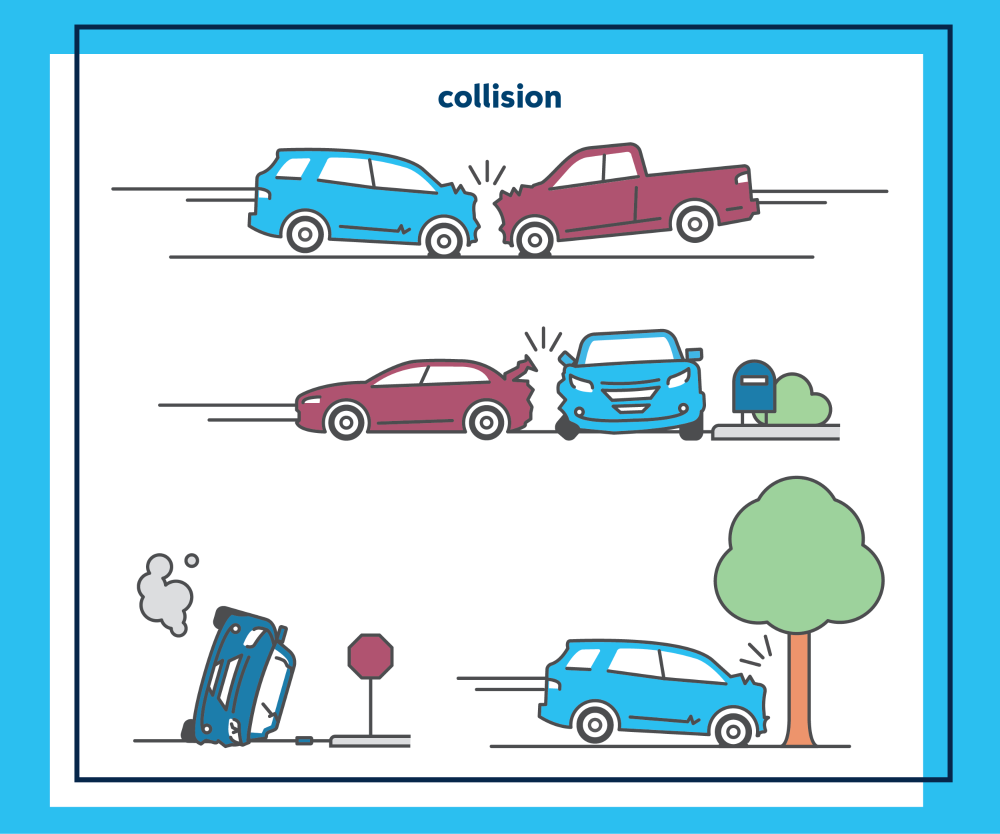

The protections differ in the scenarios in which they use. cheaper. Comprehensive coverage uses when: Your auto strikes a deer Somebody swipes your automobile Your car is damaged in a hailstorm Collision protection uses when: You swerve to miss a pet dog as well as struck a fencing One more car strikes your lorry You have a single auto loss with damage to the vehicle Why should you get thorough protection? Comprehensive coverage: Can be used despite who's at fault Aids spend for repairs, over your deductible, so you're not stuck paying the entire costs on your own Is needed by the majority of lienholders along with collision coverage.

6 Easy Facts About Automobile Insurance - Official Website Described

What is a detailed insurance deductible? A thorough insurance deductible is the amount you've concurred to pay prior to the insurer starts paying for damages. You can think about it as just how much of the economic threat you agree to tackle if you're in a crash. Commonly, the even more danger you're willing to take (greater deductible), the lower your insurance policy price would certainly be.

car car insured credit business insurance

car car insured credit business insurance

You have a $100 insurance deductible on your thorough coverage. If you have an older vehicle, you may desire to take into consideration whether you need comprehensive insurance coverage as it is usually limited to the actual money worth of your automobile.

Every U.S. state with the exemption of New Hampshire requires its motorists to buy responsibility insurance policy to drive legally. However, accident and also extensive are optional, despite the fact that almost four out of 5 vehicle drivers choose to purchase these protections. Collision protection Collision spends for damages to your automobile resulting from a collision with a things (e.

Collision insurance coverage compensates you for the expenses of fixing your automobile, minus the insurance deductible. Comprehensive protection Comprehensive covers damages to your auto created by disasters "various other than accidents," as well as costs dramatically less than accident protection.

What Is Comprehensive Insurance policy? It can aid pay for damages triggered by hail, burglary, fire or hitting an animal.

An Unbiased View of Comprehensive Car Insurance - Insurancedekho

Once you pay Go to this site that, your automobile insurance policy will certainly cover the rest of your expenses, as much as your limit. Allow's say your auto is damaged and will certainly cost $6,000 to fix, and your deductible is $1,000. You'll only pay out of pocket for the $1,000 deductible, and afterwards your insurer will pay the various other $5,000 on your extensive case.

Questions you can ask on your own to see if you need this protection are: Does your cars and truck loan provider require extensive protection? If you rent or financing, chances are they do, as well as you will not be able to obtain your automobile without it. How much is your car well worth? If it's less than what you would certainly spend for your insurance policy premium, this insurance coverage may not be worth it.

insurance company cheapest cheap car laws

insurance company cheapest cheap car laws

What Is the Distinction In Between Comprehensive and also Accident Insurance Coverage? It's very easy to blend extensive as well as accident insurance. This is because both protections shield your car. insurers. However, they cover different points. Accident insurance aids cover car crashes, while detailed protection is even more of a physical damage insurance. It aids spend for damages that are beyond your control.

laws low cost insurance cheap insurance

laws low cost insurance cheap insurance

What is thorough insurance?

Unlike liability insurance coverage, which covers other automobiles in a mishap where you're at fault, detailed insurance policy supplies insurance coverage for your lorry just when it's harmed by one of the covered perils listed on your policy. cheap insurance. While crash insurance coverage pays for your automobile when it's hit by another person, thorough protection pays for any type of damage to your car developing from a resource aside from a collision with one more chauffeur.

The 9-Second Trick For What Is Comprehensive Car Insurance Coverage?

Many lending institutions call for vehicle proprietors who purchase a car through them to lug detailed insurance policy. This is to secure the business's financial investment and, to a lower extent, you as the proprietor of the automobile (auto insurance). Even if you've paid your automobile financing off, you should still take into consideration acquiring detailed insurance coverage for your vehicle.

Opportunities are that most motorists could not manage to pay the full cost of a lorry repair work, specifically with a more recent auto. Comprehensive insurance helps to delay this price, covering everything however the insurance deductible, up to the maximum coverage quantities. What does extensive insurance coverage cover?

That requires detailed coverage? As kept in mind, a lot of loan providers will need you to have thorough protection on any type of vehicle you finance through them. On top of that, you should consider maintaining or obtaining extensive coverage even if your car is settled in the adhering to scenarios. If you rent a cars and truck: You are likewise required to have extensive insurance coverage when you rent a car.

If you stay in a high-crime area: If you reside in an area with a high-crime rate, you need to strongly consider comprehensive coverage - cheapest. Cities as well as communities with a high populace additionally tend to have a great deal of burglary and also vandalism, and chances are if you stay in such areas, you can not maintain your vehicle secured a garage every one of the moment.

You never ever recognize when catastrophe may strike in these areas, however if it does, at the very least your vehicle will certainly be insured against damage from the noted dangers. If your automobile deserves greater than the expense of your insurance coverage costs: If you own an extra pricey cars and truck, consisting of several luxury and also sport model vehicles, you might intend to shield it with extensive insurance policy.

The What Is Comprehensive Car Insurance? - The Ascent - The ... Diaries

Vehicle drivers without document of accidents, tickets, or DUIs are thought about a better risk and qualify for reduced rates. The amount of miles you drive, The much less you drive, the lower your insurance coverage costs may be. Generally, driving 7,500 miles or less in a year can qualify you for an insurance price cut with several insurance companies.

Your marriage standing, Rather or not, your marriage condition additionally figures in in what you spend for automobile insurance policy each month (automobile). Wedded vehicle drivers pay a reduced insurance costs of automobile insurance, consisting of thorough coverage. According to data from Bankrate, below is the typical expense of comprehensive insurance by state.

The most your automobile insurance will certainly ever pay out for an automobile is its real cash value - auto. Below's what you must learn about the limits, deductibles, and also other crucial factors that add to the extensive protection on your vehicle. Decreased worth, The depreciated, or diminished, value of your vehicle is what you acquired it for in the initial location minus the length of time you have actually had it.

The secret is to balance what you pay now with what you can possibly have to pay in the future. Determining what to set your deductible at boils down to a few aspects, consisting of just how much you can pay for to pay up front in contrast to what you can manage if your vehicle was harmed. vehicle.

Ways to avoid damages include driving safely, driving the rate limitation, and also car park in a secure and safeguarded area. Bear in mind that if somebody strikes you, then it gets on their responsibility insurance coverage to pay for any kind of damage to your vehicle, on your own, or your property. Perhaps you're not the ideal chauffeur and you think you may have to utilize your insurance at some factor.

An Unbiased View of What Does Comprehensive Insurance Cover? - Eatontown

One more aspect to take into account when selecting an insurance deductible is the overall worth of your car. Extra pricey automobiles set you back more to insure.

Accident insurance, on the various other hand, is developed to offer protection for a mishap brought on by an additional chauffeur, a single-car crash (including a rollover), a chauffeur crashing right into your parked automobile, an accident in a rental vehicle, and also a crash with an item (such as a mail box or structure) (affordable). In many cases, you can mix and match your extensive and crash protection deductibles.

This is because your automobile is covered versus covered perils that are most likely to happen under your thorough protection, while still managing you security from mishaps that are much less most likely to occur to excellent drivers. car insurance. Additionally, comprehensive coverage has a tendency to be less costly general than accident insurance coverage. How to browse for thorough insurance coverage estimates When looking for detailed auto insurance policy, the initial point you intend to do is obtain a selection of quotes from different insurer.

Obtain multiple quotes, You should try to find quotes from at the very least 3 different companies. This allows you to evaluate the quotes you obtain versus each other as well as pick the ideal one for your demands, according to cost, coverage, and also other options. Have a look at each business's rating, Before opting for any type of one insurance policy firm, find out what everyone else thinks concerning them.

If you desire to conserve money on car insurance, the Jerry app is a good area to start. A certified broker, Jerry does all the difficult job of finding the least expensive quotes from the leading name-brand insurance business as well as acquiring brand-new car insurance policy.

Car Insurance Faqs : Auto Insurance : State Of Oregon Fundamentals Explained

And to ensure you always have the least expensive rate, Jerry will send you brand-new quotes every time your plan turns up for renewal, so you're always getting the coverage you want at the most effective cost.